How To Trade Blog Olymp Trade Trading Strategy With Pullback Candle

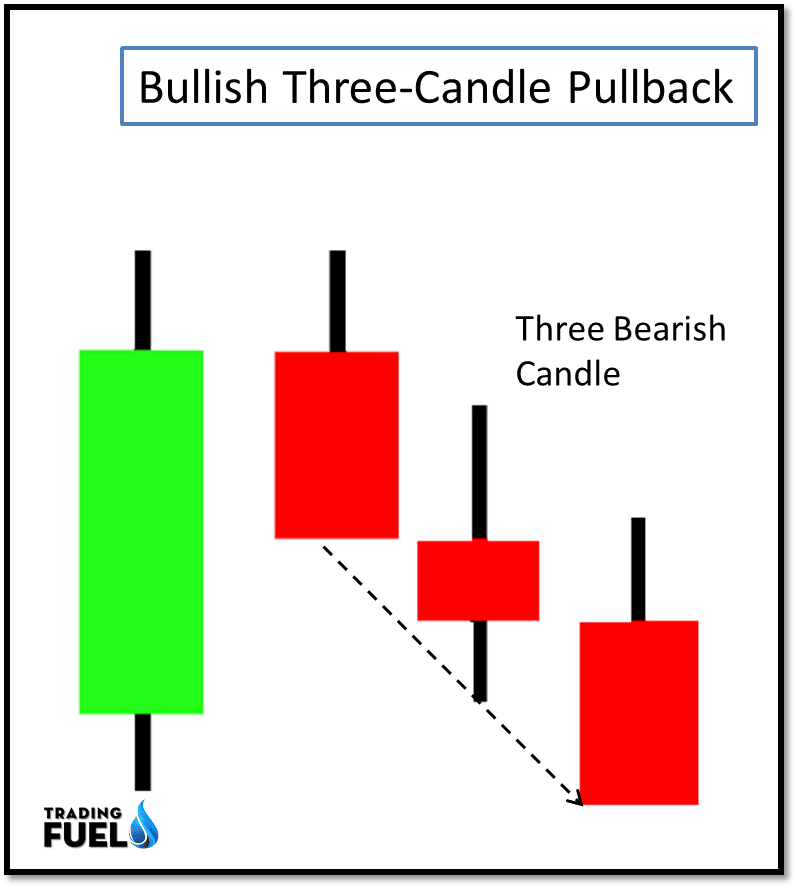

The final candle of the formation should open up in the body of the last bearish pullback candle and close above the first big bullish candlestick. If you are familiar with chart patterns, you will notice that this pattern strongly resembles a bullish flag.

Pullback Trading 5 Things to Look for Before You Place a Trade

Posted 7:00 a.m. The Emini reversed up from below yesterday's low in the first minute of the day. Although it had several consecutive bull bars, they had prominent tails. This happens more in a bull leg in a trading range than in a bull trend.

10 Price Action Candlestick Patterns Poole Squithrilve

Short Entry The 9-period TRIX is below its signal line, indicating a bearish bias. Three-bar pullback up (three consecutive bars that closed up, i.e., three green bars) Place a sell stop order just below the last bar of the three-bar pullback pattern.

TYPES OF PULLBACK! Stock trading learning, Trading charts, Forex

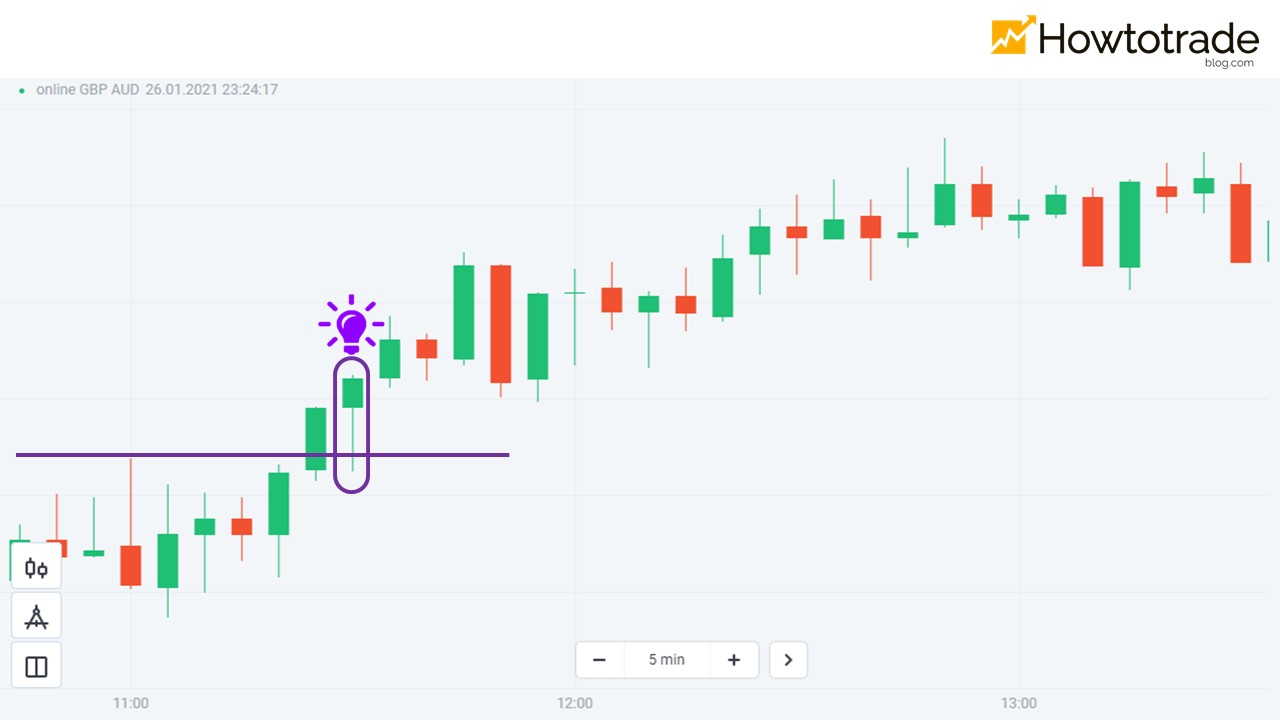

The Pullback Candlestick Strategy is a technique that uses only 2 indicators, comprises 5 simple rules , great for both short and long term moves in the Market that works in any timeframe, Stock, Forex, Cryptocurrency, Index, ETF, Emini & Commodity markets and any direction.

How to trade pullback candlestick with fixed time trades at Olymp Trade

In a downswing (impulse wave) of a downtrend, the thrusting pattern is seen as a bearish continuation pattern. On the other hand, if the pattern appears at a support level in a pullback of an uptrend, it can be considered a bullish reversal pattern.

How to recognise and trade the Pullback Candlestick on the Binomo

#1: Trade in the direction of the trend The first step to pullback trading is to identify a trend (that's relevant to your timeframe), and then trade in the direction of it. For example, if you're trading the daily timeframe, then you must have a trend on the daily timeframe. Here's what I mean:

How To Trade Blog Olymp Trade Trading Strategy With Pullback Candle

This is a Retest candlestick but not a Pullback one. Note 2: Ideally, a Pullback candlestick is created with the tail just touching the wick of the previous candle which has created the level. You can see it as shown below. This shows that, after breaking out of the level, right when the price recovers, it is pushed back by a strong force to continue the trend.

How To Find Pullback Trade Zones With HeikenAshi Candlestick Chart

The third bearish candlestick pattern that traders should look for in a pullback is the Evening Star pattern. This pattern is formed when a bullish candle is followed by a small-bodied candle, and then a bearish candle that closes below the midpoint of the first candle.

Learn how to trade a pullback candlestick pattern

Trading A Pullback: Trade Against a Trend A Pullback: Trade Against a Trend Nov 29, 2021 When reading analytical outlooks on price movements, you might run across the word "pullback". Many trading strategies are based on pullback action, and pullbacks allow you to trade against the trend.

Review Pullback Candlestick Trading Strategy On The Real Account

Learn how to use the Heiken-Ashi candlestick chart as a powerful tool to find pullback zones for low-risk entries to take advantage of market trends. Table Of Contents Pullback trading is popular among technical traders due to its simplicity. And you can use Heiken-Ashi candlesticks to make it even simpler.

Pullback Trading Strategy Trading with Smart Money

Strategy #1: Pullback Trading With Trend Lines and Channels If you like the simplicity of price action, this strategy will appeal to you. In this method, you use a trend line to define the significant trend. Then, you draw a channel to identify oversold (overbought) conditions for your entry.

Review Pullback Candlestick Trading Strategy On The Real Account

Pullback Candle will signal when price is at the end of a pullback and entering a balance phase in the market (works on all markets) Also we can expect a Pullback Candle during flash crashes as the theory of this script is when there is a turning point in momentum - this candle will appear and we can look long from this signal.

Pullback Candles (Candlestick Analysis) Guaranteed Winners

Contents [ show] Pullback candlestick characteristic Commonly, the price retraces for a while just to resume the previous direction. When such a correction happens for a duration of just one candle, this candle is called Pullback. Pullback candlestick's body is small.

Pullback Trading 7 Factors to Consider Before Placing a Trade

A valid pullback occurs when the next candle takes out the low of the previous candle, regardless of its color, and this pattern is called an impulse and correction, which helps traders understand market structure and make informed trading decisions. 📈. 03:01. Market making higher highs and impulsive moves, pullbacks are only valid if they.

Breakout entry, Pullback entry swing setup examples. Learn Forex

Candlesticks are the foundation of any price action chart. And although I do not recommend to trade candlesticks blindly - because their predictive power is not strong enough - when combining candlesticks with other confluence factors of technical analysis, a trader may improve the odds for determining the right price direction.

How To Find Pullback Trade Zones With HeikenAshi Candlestick Chart

A midday turnaround prints a small Doji candlestick, signaling a reversal, which gathers momentum a few days later, lifting more than two points into a test of the prior high. The stock then.